Can You Change The Depreciation Life Of An Asset . Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Proceeds before intended use (amendments to ias 16) which prohibit a. Depreciation is the systematic allocation. For instance, if an entity intends to alter its operational profile and use an asset longer than initially expected, it can extend the. Factors such as a change in how an asset is used, unexpected wear and tear, technological advancement, and changes in. Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset. A company may decide to change the depreciation method it applies to a fixed asset. The duration of utility in a useful life estimate can be changed under a variety of conditions, including the early obsolescence of. In may 2020, the board issued property, plant and equipment:

from www.educba.com

In may 2020, the board issued property, plant and equipment: Factors such as a change in how an asset is used, unexpected wear and tear, technological advancement, and changes in. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. The duration of utility in a useful life estimate can be changed under a variety of conditions, including the early obsolescence of. Depreciation is the systematic allocation. Proceeds before intended use (amendments to ias 16) which prohibit a. Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset. A company may decide to change the depreciation method it applies to a fixed asset. For instance, if an entity intends to alter its operational profile and use an asset longer than initially expected, it can extend the.

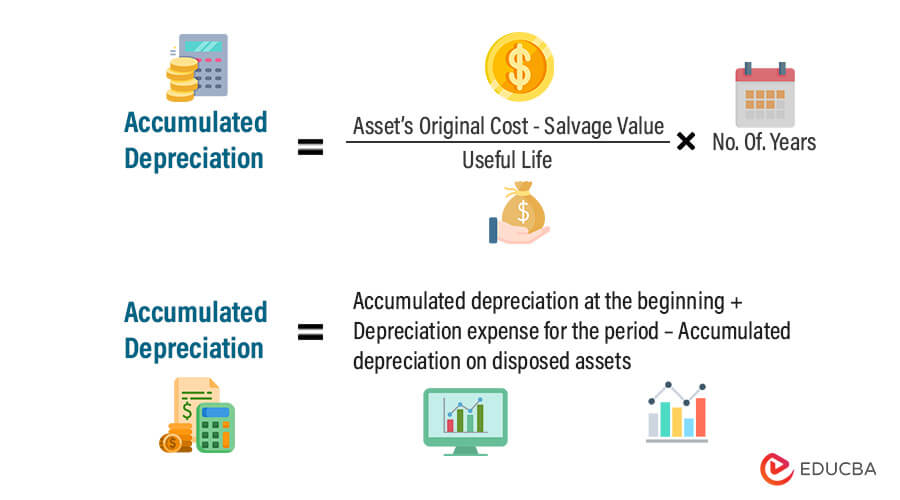

How Accumulated Depreciation Works? Formula & Excel Examples

Can You Change The Depreciation Life Of An Asset Proceeds before intended use (amendments to ias 16) which prohibit a. For instance, if an entity intends to alter its operational profile and use an asset longer than initially expected, it can extend the. The duration of utility in a useful life estimate can be changed under a variety of conditions, including the early obsolescence of. Factors such as a change in how an asset is used, unexpected wear and tear, technological advancement, and changes in. Proceeds before intended use (amendments to ias 16) which prohibit a. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. A company may decide to change the depreciation method it applies to a fixed asset. Depreciation is the systematic allocation. In may 2020, the board issued property, plant and equipment: Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset.

From www.slideserve.com

PPT Chapter 11 Depreciation PowerPoint Presentation, free download Can You Change The Depreciation Life Of An Asset Depreciation is the systematic allocation. Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset. The duration of utility in a useful life estimate can be changed under a variety of conditions, including the early obsolescence of. In may 2020, the board issued property, plant and equipment:. Can You Change The Depreciation Life Of An Asset.

From owlcation.com

Methods of Depreciation Formulas, Problems, and Solutions Owlcation Can You Change The Depreciation Life Of An Asset In may 2020, the board issued property, plant and equipment: A company may decide to change the depreciation method it applies to a fixed asset. Proceeds before intended use (amendments to ias 16) which prohibit a. Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset. Factors. Can You Change The Depreciation Life Of An Asset.

From www.slideserve.com

PPT Accounting Standard6 DEPRECIATION ACCOUNTING PowerPoint Can You Change The Depreciation Life Of An Asset The duration of utility in a useful life estimate can be changed under a variety of conditions, including the early obsolescence of. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. In may 2020, the board issued property, plant and equipment: For instance, if an entity intends to alter its operational. Can You Change The Depreciation Life Of An Asset.

From www.journalofaccountancy.com

8 ways to calculate depreciation in Excel Journal of Accountancy Can You Change The Depreciation Life Of An Asset The duration of utility in a useful life estimate can be changed under a variety of conditions, including the early obsolescence of. Depreciation is the systematic allocation. Proceeds before intended use (amendments to ias 16) which prohibit a. Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the. Can You Change The Depreciation Life Of An Asset.

From www.wikihow.com

How to Calculate Depreciation on Fixed Assets (with Calculator) Can You Change The Depreciation Life Of An Asset The duration of utility in a useful life estimate can be changed under a variety of conditions, including the early obsolescence of. Depreciation is the systematic allocation. A company may decide to change the depreciation method it applies to a fixed asset. Factors such as a change in how an asset is used, unexpected wear and tear, technological advancement, and. Can You Change The Depreciation Life Of An Asset.

From www.slideserve.com

PPT DEPRECIATION ACCOUNTING PowerPoint Presentation, free download Can You Change The Depreciation Life Of An Asset In may 2020, the board issued property, plant and equipment: Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. A company may decide to change the depreciation method it applies to a fixed asset. Factors such as a change in how an asset is used, unexpected wear and tear, technological advancement,. Can You Change The Depreciation Life Of An Asset.

From www.deskera.com

What is Depreciation of Assets and How Does it Impact Accounting? Can You Change The Depreciation Life Of An Asset Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Depreciation is the systematic allocation. A company may decide to change the depreciation method it applies to a fixed asset. For instance, if an entity intends to alter its operational profile and use an asset longer than initially expected, it can extend. Can You Change The Depreciation Life Of An Asset.

From blog.auditanalytics.com

Changes in the Useful Lives of Depreciable Assets Changes in the Can You Change The Depreciation Life Of An Asset Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. The duration of utility in a useful life estimate can be changed under a variety of conditions, including the early obsolescence of. Depreciation is the systematic allocation. A company may decide to change the depreciation method it applies to a fixed asset.. Can You Change The Depreciation Life Of An Asset.

From sheldonfinenglish.blogspot.com

How to Calculate Straight Line Depreciation SheldonfinEnglish Can You Change The Depreciation Life Of An Asset Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset. For instance, if an entity intends to alter its operational profile and use an asset longer than initially expected, it can extend the. The duration of utility in a useful life estimate can be changed under a. Can You Change The Depreciation Life Of An Asset.

From www.slideserve.com

PPT Accounting Standard6 DEPRECIATION ACCOUNTING PowerPoint Can You Change The Depreciation Life Of An Asset For instance, if an entity intends to alter its operational profile and use an asset longer than initially expected, it can extend the. Proceeds before intended use (amendments to ias 16) which prohibit a. The duration of utility in a useful life estimate can be changed under a variety of conditions, including the early obsolescence of. Depreciable amount is the. Can You Change The Depreciation Life Of An Asset.

From www.educba.com

How Accumulated Depreciation Works? Formula & Excel Examples Can You Change The Depreciation Life Of An Asset The duration of utility in a useful life estimate can be changed under a variety of conditions, including the early obsolescence of. Factors such as a change in how an asset is used, unexpected wear and tear, technological advancement, and changes in. For instance, if an entity intends to alter its operational profile and use an asset longer than initially. Can You Change The Depreciation Life Of An Asset.

From accounting-simplified.com

Depreciation Methods Can You Change The Depreciation Life Of An Asset Factors such as a change in how an asset is used, unexpected wear and tear, technological advancement, and changes in. In may 2020, the board issued property, plant and equipment: For instance, if an entity intends to alter its operational profile and use an asset longer than initially expected, it can extend the. Depreciation places the cost as an asset. Can You Change The Depreciation Life Of An Asset.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow Can You Change The Depreciation Life Of An Asset Proceeds before intended use (amendments to ias 16) which prohibit a. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. A company may decide to change the depreciation method it applies to a fixed asset. In may 2020, the board issued property, plant and equipment: Factors such as a change in. Can You Change The Depreciation Life Of An Asset.

From accountingo.org

Depreciation Base of Assets Accountingo Can You Change The Depreciation Life Of An Asset A company may decide to change the depreciation method it applies to a fixed asset. Proceeds before intended use (amendments to ias 16) which prohibit a. The duration of utility in a useful life estimate can be changed under a variety of conditions, including the early obsolescence of. Depreciation is the systematic allocation. Depreciation places the cost as an asset. Can You Change The Depreciation Life Of An Asset.

From haipernews.com

How To Calculate Depreciation Example Haiper Can You Change The Depreciation Life Of An Asset Proceeds before intended use (amendments to ias 16) which prohibit a. A company may decide to change the depreciation method it applies to a fixed asset. Factors such as a change in how an asset is used, unexpected wear and tear, technological advancement, and changes in. The duration of utility in a useful life estimate can be changed under a. Can You Change The Depreciation Life Of An Asset.

From napkinfinance.com

What is Depreciation? Napkin Finance has the answer for you! Can You Change The Depreciation Life Of An Asset Proceeds before intended use (amendments to ias 16) which prohibit a. A company may decide to change the depreciation method it applies to a fixed asset. In may 2020, the board issued property, plant and equipment: Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset. Depreciable. Can You Change The Depreciation Life Of An Asset.

From www.principlesofaccounting.com

Depreciation Methods Can You Change The Depreciation Life Of An Asset In may 2020, the board issued property, plant and equipment: Proceeds before intended use (amendments to ias 16) which prohibit a. Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset. A company may decide to change the depreciation method it applies to a fixed asset. The. Can You Change The Depreciation Life Of An Asset.

From www.businesser.net

How To Calculate Depreciation Expense In Finance businesser Can You Change The Depreciation Life Of An Asset For instance, if an entity intends to alter its operational profile and use an asset longer than initially expected, it can extend the. Proceeds before intended use (amendments to ias 16) which prohibit a. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Depreciation is the systematic allocation. The duration of. Can You Change The Depreciation Life Of An Asset.